Starting a business in Mexico can be an exciting venture, especially for LGBTQ+ individuals seeking new opportunities. Gaymexico.net is here to guide you through the process, ensuring a smooth and successful launch. We will explore the essential steps, from legal requirements to cultural considerations, empowering you to establish your business in Mexico with confidence. Leverage this guide to unlock opportunities and navigate the Mexican business landscape.

1. Selecting Your Business Name in Mexico

Does the name of your business matter in Mexico? It certainly does.

The first step involves securing authorization for your company’s name from the Mexican Ministry of Economy. It is advisable to submit a list of four to five potential names, ranked in order of preference, to your Notary Public. This list is then used to file for name registration. While all names might be accepted, there’s also a chance they could be rejected. Registering multiple names simultaneously saves time, as the process takes approximately one week. Remember that this is the legal name of your company and not necessarily your brand or commercial name.

2. Choosing The Governing Body

Who will lead your business in Mexico?

The governing body can be structured as a Board of Directors, comprising at least two individuals, or a Sole Administrator. Depending on the scale of your operation, you may also appoint a secretary, treasurer, and president. Once the governing body is chosen, collect identification and proof of address from each member, as this information will be required later.

3. Providing Shareholders’ (Partners’) Information

Who are the shareholders in your Mexican company?

The company’s shareholders can be individuals or other companies. Ensuring accurate and complete information is vital for compliance and transparency.

3.1. Individual Shareholders

What information is needed from individual shareholders?

For individual shareholders, the required details include their full name, passport, and proof of address. They can either travel to Mexico or appoint a representative through a power of attorney to handle the incorporation process. If traveling to Mexico, they must declare that the primary purpose of their visit is to conduct business activities upon arrival.

3.2. Corporate Shareholders

What documents are required when a company is a shareholder?

If the shareholders are other companies, the Signing Officer must sign the necessary documents. Similar to individual shareholders, the Signing Officer can travel to Mexico or authorize a representative via a power of attorney. It’s essential to state the visit’s purpose as business activities.

For the legal representative, you’ll need their full name, passport, and proof of address. If represented, the designated person must provide an apostilled power of attorney along with a copy of their passport.

The following documents are required for the company:

- Certificate of Formation / Articles of Incorporation (duly apostilled)

- Certificate of Legal Standing

- Bylaws (duly apostilled)

- Appointment of Signing Officer / Representative with Power of Attorney (duly apostilled)

- The ID of the Signing Officer or Representative with Power of Attorney

- TIN (Tax Identification Number)

3.3. Understanding Beneficial Ownership

Why is identifying beneficial owners crucial in Mexico?

Since 2022, Mexico’s Federal Fiscal Code has been amended to include new obligations for Mexican companies to document information about their Beneficial Owners. This information is integral to your accounting and must be stored physically at the company’s registered address.

Article 32-B Quater of Mexico’s Fiscal Code defines a Beneficial Owner as the individuals behind corporate structures. If a legal entity (company or trust fund) is a shareholder of the Mexican company, the Notary Public must identify every shareholder in that company. This extends to identifying all shareholders of any legal entity within the ownership structure.

3.3.1. Penalties for Non-Compliance

What are the penalties for failing to identify and document beneficial owners?

Article 84 M of the Federal Fiscal Code outlines the penalties for failing to comply with Article 32-B Quater. Failure to identify and document a company’s Beneficial Owners, keep their information updated, or present it to the authority on time constitutes an infringement.

Article 84 N of the Federal Fiscal Code specifies the fines for these infringements, converted to USD:

| Infringement | Fine (USD) |

|---|---|

| Not identifying and documenting Beneficial Owners | $77,000 – $100,000 per Beneficial Owner |

| Not updating Beneficial Owner information | $40,000 – $50,000 per Beneficial Owner |

| Not presenting Beneficial Owner information to the authority on time | $25,000 – $40,000 per Beneficial Owner |

These fines can accumulate significantly. A company with ten Beneficial Owners could face charges of up to one million dollars.

Notary publics and anyone involved in the company’s incorporation are responsible for gathering and documenting this information. The substantial fines have led to a cautious approach, with many preferring to avoid the risk if identifying Beneficial Owners proves challenging. This can be particularly complex for public companies with numerous shareholders, including trust funds with their own sets of shareholders.

4. Incorporating Before A Notary Public

How does a Notary Public formalize your company in Mexico?

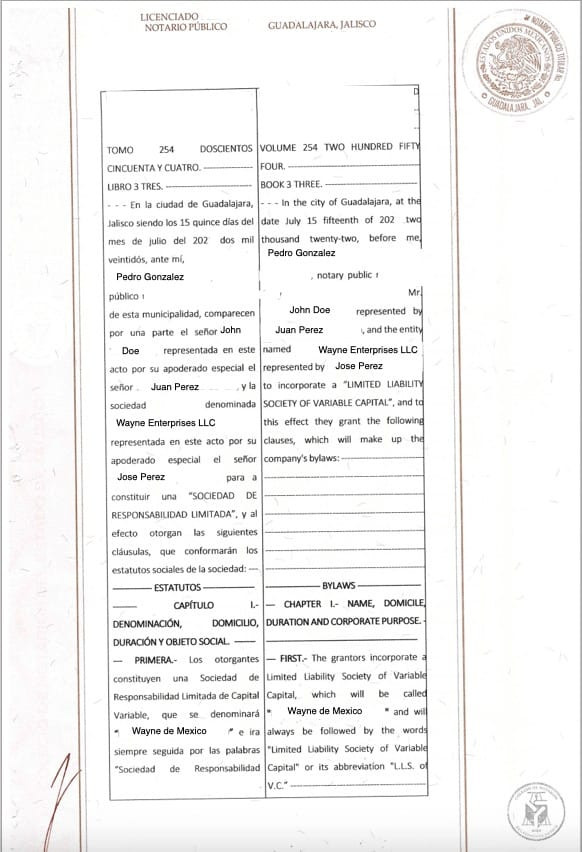

Now that you’ve registered the name with the Ministry of Economy and gathered all necessary documents, it’s time to meet with the Notary Public. They will help you draft a constitutive act, which includes the company’s articles of incorporation and bylaws. This document covers all general aspects of the company, such as the company name, business objective, type of company, administration, and duration.

The company must issue registered share certificates and record shareholders in the Company Stock Registry Book.

Example of the incorporation deed of a Mexican company

Example of the incorporation deed of a Mexican company

Example of a Mexican Incorporation Deed showcasing the formal legal document required for business registration.

5. Public Property And Commerce Registration

Why is registering with the Public Property and Commerce Registry important?

Every company established in Mexico must be registered in the Public Property and Commerce Registry, which maintains a public record of merchants. The Notary Public typically handles this registration after the incorporation deed is signed.

This registry operates at the state level, with each state having its own public registry and charging its state taxes. In practice, the registration location within Mexico doesn’t significantly impact your business, as you can open branches in any state.

6. Leasing Of A Registered Address

Is a physical address necessary for business registration in Mexico?

Yes, according to Mexico’s Federal Tax Code, virtual addresses are not permitted. The law mandates that the registered address must be a physical location where you keep your corporate books and accounting records. Therefore, regardless of your business model, you must lease a registered address, which typically costs between US $50 to $100 per month.

7. Federal Tax Payers Registration

How do you register your business with the Mexican IRS?

With your company fully incorporated, the next step is to register with the Secretaria de Administracion Tributaria (SAT), the Mexican IRS. The company’s legal representative, designated in the constitutive act, handles this process. They will obtain the company’s Federal Tax Identification Number, known as Registro Federal de Contribuyentes (RFC). This number is essential for all transactions.

During the same meeting, the legal representative will obtain their electronic signature, consisting of digital files and a password, to act on behalf of the company. This signature is personal and must be obtained by any new legal representative if there are changes in the role.

To obtain the Tax ID, the legal representative must present the following:

- The incorporation deed stating their faculties in the company

- The leasing agreement as proof of address

- A copy of their ID and the appointment

8. Opening A Corporate Bank Account

What is needed to open a bank account for your Mexican company?

The legal representative then contacts a bank to open a corporate bank account. The process is similar to other countries, requiring the tax ID, company’s proof of address, the legal representative’s ID, and any other documents as required by the bank.

9. Social Security Mexican Institute Registration

How do you register your business with the Mexican Social Security Institute?

The final step is registering your business with the Social Security Mexican Institute, or Instituto Mexicano del Seguro Social (IMSS), even if you are the only employee.

10. Maintaining Corporate Books In Mexico

What corporate books are required for Mexican companies?

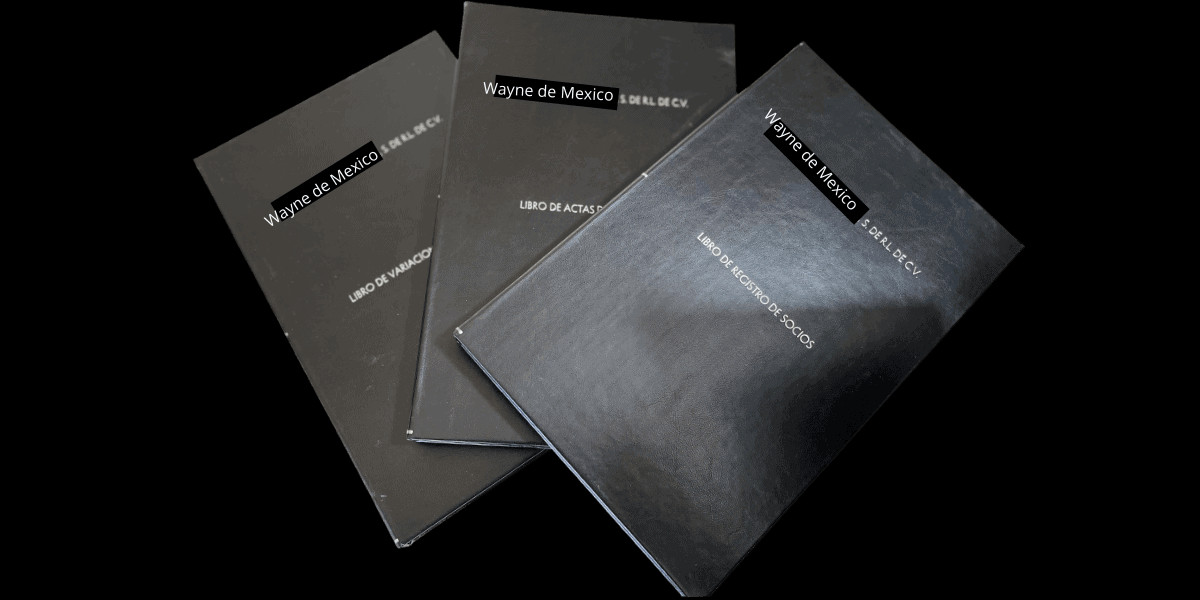

Once your company is incorporated, the notary public will provide your company’s corporate books. If not, you’ll need to acquire them. These are physical books with sequenced sheets of paper that companies must fill out and update as required by law.

These books are part of your company’s accounting records and should be kept at your registered address in case of an audit. Although compliance rates may vary, keeping everything in order is always best.

An example of a Mexican company

An example of a Mexican company

An example of the physical corporate books that Mexican companies are legally required to maintain.

The corporate books of a Mexican company consist of the following:

- Shareholders’ Registration Book

- Shareholders’ Meetings Minutes Book

- Changes In Stock Capital Book

10.1. Shareholders’ Registration Book

Why is it necessary to maintain a Shareholders’ Registration Book?

Mexican companies must maintain a physical book with detailed information for each shareholder.

10.2. Shareholders’ Meetings Minutes Book

What needs to be recorded in the Shareholders’ Meetings Minutes Book?

By law, companies in Mexico must hold an annual ordinary shareholders’ meeting to approve the company’s financial statements and make decisions for continued operation. These meetings must be documented in minutes or notes, which are then appended to the Shareholders’ Meetings Minutes Book.

10.3. Changes In Stock Capital Book

How are changes in stock capital documented?

The term “CV,” short for Capital Variable, appears after most company names, indicating Variable Stock Capital. This means the company can increase or decrease capital stock as needed, such as when adding a new shareholder who contributes capital. Every increase in capital stock should be registered in this book. Formalizing these changes before a notary public provides “date certainty,” which is essential for legal proof in Mexican courts.

11. Equity Legal Reserve

What is the purpose of an Equity Legal Reserve?

According to Article 20 of the General Law of Commercial Corporations and Partnerships, companies in Mexico must create an asset account called “Legal Reserve,” with some exemptions. This reserve serves as a fund to help the company manage financial contingencies that could lead to defaulting on payments to third parties, including the government.

Navigating LGBTQ+ Considerations in Mexico

How can LGBTQ+ individuals ensure a welcoming business environment in Mexico?

Mexico has made significant strides in LGBTQ+ rights, including legalizing same-sex marriage nationwide as of 2022. However, societal attitudes can vary, and it’s essential to be aware of local customs and sensitivities.

| Area | Details |

|---|---|

| Legal Protections | Mexico has federal anti-discrimination laws that protect against discrimination based on sexual orientation and gender identity. However, enforcement can vary by state. |

| Cultural Norms | While major cities like Mexico City and Puerto Vallarta are known for their LGBTQ+ friendliness, attitudes in more rural areas can be more conservative. Be mindful of local customs and exercise discretion when displaying affection in public. |

| Business Practices | In business settings, professionalism is key. Focus on building strong relationships and demonstrating your expertise. While it’s generally safe to be open about your identity, gauge the comfort level of your counterparts and adjust your approach accordingly. |

| Networking Opportunities | Several LGBTQ+ business organizations and networks in Mexico can provide support and connections. Consider joining these groups to expand your network and gain insights into the local business environment. |

| Safety Tips | Research local laws and customs before traveling to specific regions. Stay informed about any potential safety concerns and take necessary precautions. |

| Resources | Gaymexico.net offers a wealth of information and resources for LGBTQ+ travelers and business professionals in Mexico. Consider exploring the site for guidance on safe travel, LGBTQ+-friendly destinations, and networking opportunities. Additionally, the UCLA Williams Institute provides valuable research and data on LGBTQ+ issues in Mexico and beyond, further informing your business journey. |

Navigating the Mexican business landscape as an LGBTQ+ individual involves blending professionalism with cultural sensitivity. By understanding the legal protections, cultural norms, and business practices, you can create a welcoming and successful environment for your venture.

Intentions for Individuals to Start a Business

What are the various search intentions related to starting a business in Mexico?

Here are five key search intentions for individuals looking to start a business in Mexico:

- Informational: To understand the steps and requirements for starting a business in Mexico.

- Legal: To learn about the legal structures, tax obligations, and regulations involved in setting up a business.

- Financial: To explore funding options, investment opportunities, and financial planning for a new business.

- Logistical: To find resources and support for setting up operations, including office space, staffing, and supply chain management.

- Networking: To connect with other entrepreneurs, mentors, and business professionals in Mexico for guidance and support.

Frequently Asked Questions (FAQ) About Starting a Business in Mexico

Do you have questions about starting a business in Mexico?

Here are some frequently asked questions to help guide you:

- What are the most common types of business entities in Mexico? The most common types include Sociedad Anónima (SA), Sociedad de Responsabilidad Limitada (SRL), and Sociedad por Acciones Simplificada (SAS).

- How long does it take to start a business in Mexico? The process typically takes between 4 to 8 weeks, depending on the complexity and efficiency of the paperwork.

- What are the main taxes that a company must pay in Mexico? The main taxes include Income Tax (ISR), Value Added Tax (IVA), and payroll taxes.

- Do I need a local partner to start a business in Mexico? No, it is not legally required to have a local partner, but it can be beneficial for navigating the local business environment.

- What is the minimum capital required to start a business in Mexico? The minimum capital requirement varies depending on the type of business entity. For an SRL, there is no legally defined minimum, but it is recommended to have sufficient capital to cover initial expenses.

- Can a foreigner be the legal representative of a company in Mexico? Yes, a foreigner can be the legal representative, but they must have a valid visa and comply with all Mexican immigration laws.

- What is the process for obtaining a tax ID (RFC) in Mexico? The legal representative must register the company with the SAT, providing the incorporation deed, proof of address, and their identification.

- Are there any specific regulations for foreign investment in Mexico? While Mexico generally encourages foreign investment, certain sectors like energy and media may have restrictions.

- How can I protect my intellectual property in Mexico? You can register your trademarks and patents with the Mexican Institute of Industrial Property (IMPI).

- What resources are available to help me start a business in Mexico? Gaymexico.net offers valuable insights and resources, along with other organizations like the Mexican Ministry of Economy and local chambers of commerce.

Conclusion: Your Path to Entrepreneurial Success in Mexico

Starting a business in Mexico can be a fulfilling and prosperous venture for LGBTQ+ individuals. By understanding the necessary steps, legal requirements, and cultural considerations, you can navigate the Mexican business landscape with confidence. Gaymexico.net is committed to providing you with the resources and support you need to succeed.

Ready to take the next step? Visit gaymexico.net to discover detailed travel guides, find LGBTQ+-friendly events, and connect with the community in Mexico.

Contact us for more information and personalized assistance:

Address: 3255 Wilshire Blvd, Los Angeles, CA 90010, United States

Phone: +1 (213) 380-2177

Website: gaymexico.net

Start your entrepreneurial journey in Mexico today with the support of gaymexico.net!