Can I Get A Mexican Credit Card? Yes, it’s entirely possible! At gaymexico.net, we understand the challenges and opportunities that come with living or traveling in Mexico as part of the LGBTQ+ community. Obtaining a Mexican credit card can be a significant step towards financial convenience and building a local credit history. Let’s explore how you can navigate this process, opening doors to local financial services while enjoying all that Mexico has to offer. Discover tips and advice for LGBTQ+ travelers and residents to help you thrive in Mexico.

1. Understanding Credit in Mexico for Expats

How does the Mexican credit system differ from that of other countries? Understanding the nuances of the Mexican credit system is crucial for any expat looking to obtain a local credit card.

When you relocate to Mexico, your credit history from your home country doesn’t automatically transfer. You’re essentially starting from scratch in building your credit profile. This new credit history is built on your financial activities within Mexico, including your income and banking history. It’s important to establish a positive financial track record to improve your chances of getting approved for a credit card. Building a solid credit history can pave the way for financial opportunities, such as securing a mortgage or accessing better loan terms.

According to research from the UCLA Williams Institute, in July 2025, understanding local financial systems is vital for expats seeking to integrate fully into Mexican society.

Mexican art

Mexican art

Alt text: Colorful Mexican mural depicting cultural symbols.

2. Key Considerations Before Applying for a Mexican Credit Card

What should expats consider before applying for a credit card in Mexico? Before diving into the application process, it’s essential to understand a few key aspects of credit cards in Mexico.

2.1. Building Credit History in Mexico

Your credit history from your home country doesn’t transfer, so start building a new one with local financial activities. A verifiable income and a consistent banking history in Mexico are crucial for establishing creditworthiness. This may involve opening a local bank account and ensuring regular deposits.

2.2. Conservative Lending Practices

Traditional Mexican banks are generally conservative, making it harder for expats to get credit cards initially. Unlike in some other countries, banks in Mexico may not actively seek new credit card customers.

2.3. High-Interest Rates

Interest rates on credit card balances in Mexico can be significantly higher than in countries like the U.S., Canada, or the UK. According to a recent audit by Banxico (Mexico’s central bank), annual interest rates (CAT rate) on unpaid balances can range from 47% to 120%.

2.4. Credit History for Mortgages

Having a credit history in Mexico is typically required to take out a mortgage. Banks often require a credit history of a year or more before issuing a loan.

2.5. Acceptance of Mexican Cards

Many Mexican service providers, especially utilities and internet companies, may only accept Mexican credit cards. Expats without a local credit card often end up paying bills in cash or via electronic transfer from a local bank account.

3. What Credentials Do I Need to Get a Mexican Credit Card?

What documents are generally required to apply for a credit card in Mexico? Gathering the necessary documents is a critical step in applying for a credit card in Mexico.

The requirements can vary depending on the issuer, so it’s always a good idea to check directly with the bank or store. Here’s a general guide of what you’ll likely need:

3.1. Proof of Residency

A Mexican residency visa, either FM2 or FM3 (temporary or permanent residency visa), is typically required.

3.2. Passport

Your passport serves as essential identification.

3.3. Verifiable Income

Provide pay stubs or a history of monthly deposits in a local bank account.

3.4. Local Bank Account

Proof of a local bank account is essential. The length of time the account needs to be active varies by bank.

3.5. Proof of Address

A utility bill from CFE (Comisión Federal de Electricidad) or Siapa (Sistema Intermunicipal de Agua Potable y Alcantarillado) is generally accepted.

3.6. RFC Number

Your Registro Federal de Contribuyentes (RFC) number, your tax payer ID in Mexico, issued by SAT (Servicio de Administración Tributaria).

3.7. CURP Number

Your Clave Única de Registro de Población (CURP) number.

3.8. Age Requirement

You must be at least 18 years old.

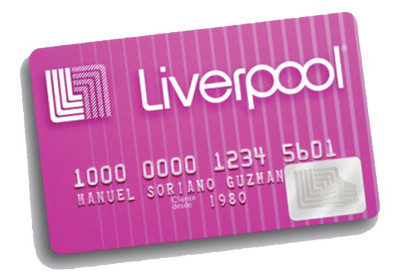

Liverpool credit card

Liverpool credit card

Alt text: Close-up of a Liverpool department store credit card.

4. Where Can I Apply for a Credit Card in Mexico?

Where are the best places for expats to apply for a credit card in Mexico? Knowing where to apply can significantly increase your chances of getting approved for a credit card.

4.1. General Cards

These cards can be used at any business that accepts credit cards.

4.1.1. Banco Azteca

The financial arm of Grupo Elektra offers a variety of card options, some backed by Mastercard and others by Visa. They provide credit to underserved Mexicans and offer cards like the “Oro” (Gold) and ABC Basic cards, which do not charge an annual fee. Perks on the Gold card include discounts at Cineapolis and Starbucks. The average CAT on the Gold card is around 119%, without VAT.

4.1.2. Nu Bank

This Brazilian fin-tech startup operates in Mexico, targeting under-banked citizens. Applying for credit from Nu Bank is straightforward via their mobile app. The Nubank credit card is backed by Mastercard Gold and has no annual fee or penalty for minimal use. New cardholders can expect a very low credit limit initially. The average CAT rate is approximately 140%, without VAT.

4.1.3. Inbursa

Inbursa’s “Oro” card is a good option for foreigners seeking credit. Although they’ve instituted an annual fee of $516 MXN and the average CAT is 58.2%, it still offers benefits like earning AeroMexico points and discounts at Sanborn’s stores.

4.2. Store Cards

Major department stores often offer easier access to credit than banks.

4.2.1. Liverpool

Liverpool offers its customers a credit card with decent terms. The average CAT is currently 27.1%, with an annual fee of $399 MXN. Cardholders also receive exclusive discounts in stores.

4.2.2. El Palacio de Hierro

This luxury retailer offers a few different credit options and access to an exclusive wine club.

4.2.3. Coppel

Expats have reportedly obtained cards from this department store with no credit history in Mexico. There is no annual fee, though the average CAT rate on the BanCoppel card is around 85.6%.

department store

department store

Alt text: Interior of a brightly lit department store showcasing various products.

5. Navigating the Application Process as an LGBTQ+ Individual

Are there specific considerations for LGBTQ+ individuals applying for credit cards in Mexico? While Mexico has made strides in LGBTQ+ rights, it’s essential to be aware of potential challenges and resources.

5.1. Legal Protections

Mexico has laws in place to protect against discrimination, including sexual orientation. According to Human Rights Watch, Mexico has made significant progress in LGBTQ+ rights, including legalizing same-sex marriage nationwide. Ensure that you are treated fairly and without discrimination during the application process.

5.2. Community Support

Connect with LGBTQ+ organizations in Mexico for support and advice. Organizations like All Out provide resources and advocacy for LGBTQ+ rights in Mexico.

5.3. Financial Planning

Consider working with a financial advisor who understands the unique needs of the LGBTQ+ community. They can provide tailored advice on building credit and managing finances.

5.4. Cultural Sensitivity

Be aware of cultural nuances and sensitivities when interacting with financial institutions. While major cities are generally more accepting, smaller towns may have more conservative attitudes.

6. Using Your Mexican Credit Card Responsibly

How can expats use their Mexican credit cards wisely? Responsible credit card usage is vital to avoid high-interest charges and maintain a good credit score.

6.1. Pay Off Balances in Full

Always aim to pay off your credit card balance in full each month to avoid incurring high-interest charges. The interest rates on Mexican credit cards can be significantly higher than in other countries.

6.2. Monitor Your Spending

Keep track of your credit card spending to stay within your budget. Use mobile banking apps or online statements to monitor your transactions regularly.

6.3. Set Up Payment Reminders

Set up payment reminders to ensure you never miss a due date. Late payments can negatively impact your credit score and result in additional fees.

6.4. Avoid Cash Advances

Avoid taking out cash advances on your credit card, as they typically come with high fees and interest rates.

6.5. Review Your Credit Report

Regularly review your credit report to ensure its accuracy. You can check your credit history at Buró de Crédito for a small fee.

7. Alternative Options for Building Credit in Mexico

What are some alternative ways to build credit in Mexico? If you’re finding it difficult to get approved for a traditional credit card, there are alternative options to consider.

7.1. Secured Credit Cards

Consider a secured credit card, which requires you to provide a security deposit that serves as your credit limit. This can be a good way to start building credit if you have a limited credit history.

7.2. Credit-Builder Loans

Explore credit-builder loans from local banks or credit unions. These loans are designed to help you build credit by making regular payments over a set period.

7.3. Retail Store Credit

Opening a credit account with a retail store can be an easier way to start building credit, as the requirements are often less stringent than those for traditional credit cards.

Mexican street

Mexican street

Alt text: A vibrant street scene in Mexico with colorful buildings and people.

8. Benefits of Having a Mexican Credit Card

What are the advantages of having a local credit card in Mexico? Obtaining a Mexican credit card can offer numerous benefits, especially for expats and LGBTQ+ travelers.

8.1. Convenience and Safety

A Mexican credit card provides a convenient and safe way to pay for everyday expenses, reducing the need to carry large amounts of cash.

8.2. Online Shopping

It facilitates online shopping and payments, as many Mexican websites require a local credit card.

8.3. Building Credit History

It helps you build a credit history in Mexico, which is essential for accessing other financial products like mortgages and loans.

8.4. Local Services

It allows you to pay for local services, such as utilities and internet, which may not accept foreign credit cards.

8.5. Exclusive Discounts

Many Mexican credit cards offer exclusive discounts and perks at local stores and restaurants.

9. Resources for LGBTQ+ Expats in Mexico

Where can LGBTQ+ expats find support and information in Mexico? Navigating life in a new country can be challenging, and having access to reliable resources is essential for LGBTQ+ expats.

9.1. LGBTQ+ Organizations

Connect with local LGBTQ+ organizations for support, information, and community. Organizations like All Out provide resources and advocacy for LGBTQ+ rights in Mexico.

9.2. Online Forums

Join online forums and social media groups for LGBTQ+ expats in Mexico. These platforms can provide valuable insights and advice from others who have gone through similar experiences.

9.3. Travel Guides

Refer to LGBTQ+ travel guides for information on gay-friendly destinations, events, and accommodations in Mexico. Websites like gaymexico.net offer comprehensive travel guides and resources.

9.4. Legal Assistance

Seek legal assistance from attorneys specializing in LGBTQ+ rights if you encounter discrimination or other legal issues.

9.5. Mental Health Services

Access mental health services from therapists and counselors who are LGBTQ+ affirming and understand the unique challenges faced by expats.

10. Staying Safe and Informed in Mexico

How can LGBTQ+ individuals stay safe and informed while living or traveling in Mexico? Safety and awareness are crucial for LGBTQ+ individuals in Mexico.

10.1. Research Local Laws

Stay informed about local laws and regulations related to LGBTQ+ rights. While Mexico has made significant progress, attitudes can vary by region.

10.2. Be Aware of Your Surroundings

Be aware of your surroundings and avoid potentially unsafe situations. Stick to well-lit and populated areas, especially at night.

10.3. Trust Your Instincts

Trust your instincts and remove yourself from any situation that makes you feel uncomfortable or unsafe.

10.4. Emergency Contacts

Keep a list of emergency contacts, including local authorities, LGBTQ+ organizations, and your embassy or consulate.

10.5. Travel Insurance

Consider purchasing travel insurance that covers medical emergencies, theft, and other unforeseen events.

FAQ: Mexican Credit Cards for Expats

1. Can I get a Mexican credit card without a Mexican bank account?

It’s highly unlikely. Most Mexican banks require you to have an active account with them before they’ll consider you for a credit card.

2. What is the minimum credit score required to get a credit card in Mexico?

Since your foreign credit history doesn’t transfer, you’ll be starting from scratch. The focus will be on your Mexican income and banking history.

3. How long does it take to build a credit history in Mexico?

It can take anywhere from six months to a year to start building a noticeable credit history in Mexico.

4. Are there any credit cards in Mexico that don’t charge annual fees?

Yes, some cards like the Banco Azteca Oro and Nubank credit card do not charge annual fees.

5. Can I use my Mexican credit card in the United States?

Yes, if your card is affiliated with a major international network like Visa or Mastercard, you can use it in the United States.

6. What should I do if my credit card is lost or stolen in Mexico?

Report the loss or theft immediately to your bank. They will cancel your card and issue a new one.

7. Can I get a cash advance on my Mexican credit card?

Yes, but it’s generally not recommended due to high fees and interest rates.

8. Do Mexican credit cards offer rewards programs?

Yes, many Mexican credit cards offer rewards programs such as cashback, points, or airline miles.

9. What is the CAT rate on Mexican credit cards?

The CAT (Costo Anual Total) rate is the total annual cost of the credit card, including interest, fees, and other charges. It can range from 27% to over 100%.

10. Can I pay my Mexican credit card bill online?

Yes, most Mexican banks offer online bill payment options.

Obtaining a Mexican credit card is a significant step towards financial convenience and integration into the local community. At gaymexico.net, we are committed to providing you with the resources and information you need to navigate life in Mexico as an LGBTQ+ individual. By following these guidelines and staying informed, you can confidently apply for and use a Mexican credit card, enhancing your financial freedom and enjoying all that Mexico has to offer.

Ready to explore Mexico? Visit gaymexico.net for comprehensive travel guides, event listings, and community connections. Discover LGBTQ+-friendly destinations, connect with local organizations, and find valuable resources to make your experience safe, enjoyable, and unforgettable. Your adventure awaits!

Address: 3255 Wilshire Blvd, Los Angeles, CA 90010, United States

Phone: +1 (213) 380-2177

Website: gaymexico.net