Are you trying to find out “A Cuanto Esta El Dolar En Mexico Por Elektra”? At gaymexico.net, we understand the importance of getting the best exchange rate when sending money to Mexico. Our guide provides up-to-date information, practical tips, and reliable resources to help you make informed decisions and maximize the value of your remittances. You’ll discover insights into LGBTQ+ friendly financial practices, currency exchange options, and tips for safe money transfers.

1. Understanding the Dollar to Peso Exchange Rate in Mexico

The dollar to peso exchange rate is constantly changing, influenced by a variety of economic factors. Understanding these fluctuations is key to getting the most out of your money when sending it to Mexico.

1.1. What Factors Influence the USD to MXN Exchange Rate?

Several factors impact the USD to MXN exchange rate, including:

- Economic Stability: Mexico’s economic health, including its GDP growth, inflation rates, and unemployment figures, plays a significant role.

- Interest Rates: Higher interest rates in Mexico can attract foreign investment, increasing the demand for the peso and strengthening its value.

- Political Stability: Political events, policy changes, and government stability can influence investor confidence and currency values.

- Global Market Conditions: International trade, commodity prices (especially oil, a major export for Mexico), and global economic trends can all affect the peso’s value.

- US Economic Performance: The strength of the US economy directly impacts the dollar’s value, which in turn affects the exchange rate.

1.2. How Can I Stay Updated on the Exchange Rate?

Staying informed about the current exchange rate is crucial. Here are some reliable resources:

- Financial Websites: Websites like Bloomberg, Reuters, and Yahoo Finance provide real-time exchange rate data and financial news.

- Central Banks: The Bank of Mexico (Banxico) provides official exchange rate information and economic analysis.

- Money Transfer Services: Services like Pangea Money Transfer often display the current exchange rate when you initiate a transaction.

- Financial News Outlets: Major news sources like the Wall Street Journal and the Financial Times offer in-depth coverage of currency markets.

2. Elektra and Banco Azteca: A Convenient Option for Money Transfers

Elektra, along with its banking arm Banco Azteca, offers a popular way for people in the United States to send money to Mexico. Known for their widespread presence and extended hours, they provide accessible financial services, particularly for those without traditional bank accounts.

2.1. What Are the Benefits of Using Elektra for Money Transfers?

Elektra provides several advantages for those looking to send money to Mexico:

- Wide Network: Elektra has numerous locations throughout Mexico, making it easy for recipients to access funds.

- Extended Hours: Many Elektra stores have longer operating hours than traditional banks, offering greater convenience.

- Accessibility: Elektra and Banco Azteca cater to a broad customer base, including those who may not have bank accounts.

- Familiarity: Many Mexicans are familiar with Elektra, making it a trusted option for receiving money.

2.2. What Are the Potential Drawbacks?

Despite the advantages, there are potential drawbacks to consider:

- Exchange Rates: Elektra’s exchange rates may not always be the most competitive compared to other money transfer services.

- Fees: Fees for sending and receiving money can add up, reducing the amount the recipient ultimately receives.

- Debt Offset: As mentioned in the original article, Elektra may use incoming funds to offset any existing debts the recipient has with the company.

- Limited Transfer Amounts: There may be limits on how much money can be sent or received in a single transaction or within a specific timeframe.

A customer withdrawing money from Banco Azteca, highlighting its accessibility.

A customer withdrawing money from Banco Azteca, highlighting its accessibility.

2.3. How to Send Money to Mexico for Pickup at Elektra

If you decide to use Elektra, here’s how the process typically works:

- Choose a Money Transfer Service: Select a service that partners with Elektra, such as Pangea Money Transfer.

- Create an Account: Sign up for an account on the chosen platform.

- Enter Recipient Details: Provide the recipient’s full name and contact information.

- Select Elektra as the Pickup Location: Specify that the recipient will pick up the funds at an Elektra location.

- Pay for the Transfer: Pay for the transfer using a credit card, debit card, or bank account.

- Notify the Recipient: Inform the recipient that the funds are available and provide them with the necessary reference number.

- Recipient Collects the Funds: The recipient visits an Elektra location with a valid ID and the reference number to collect the money.

3. Alternatives to Elektra for Sending Money to Mexico

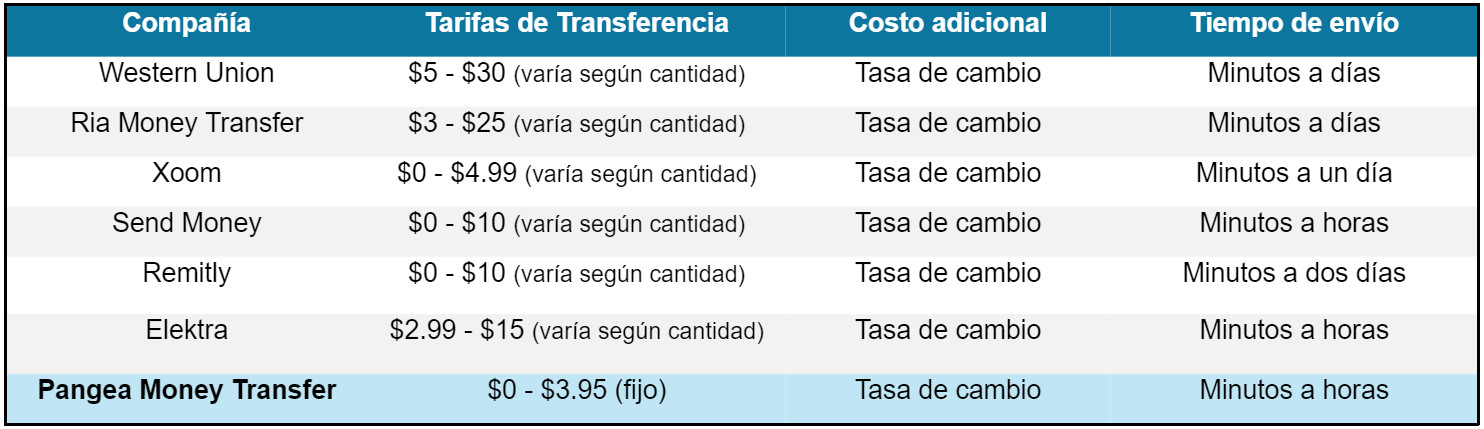

While Elektra is a popular choice, there are numerous alternative options that may offer better exchange rates, lower fees, or additional convenience.

3.1. Online Money Transfer Services

Online money transfer services have revolutionized how people send money internationally. They often offer competitive exchange rates and lower fees compared to traditional methods.

3.1.1. Pangea Money Transfer

Pangea Money Transfer stands out as a reliable and cost-effective option. Pangea Money Transfer offers a flat fee of $3.95 for cash pickups and a maximum transfer amount of $3,000 USD, potentially increasing to $6,000 USD.

3.1.2. Wise (formerly TransferWise)

Wise is known for its transparent fee structure and mid-market exchange rates. It allows users to send money directly to bank accounts in Mexico.

3.1.3. Remitly

Remitly offers fast and reliable transfers to Mexico, with various delivery options, including bank deposits and cash pickups at partner locations.

3.1.4. Xoom (a PayPal service)

Xoom provides a convenient way to send money through PayPal, offering a range of delivery options in Mexico.

3.2. Traditional Money Transfer Services

Traditional money transfer services have been around for decades and are still widely used, particularly by those who prefer in-person transactions.

3.2.1. Western Union

Western Union has a vast network of agent locations worldwide, making it easy to send and receive money in person.

3.2.2. MoneyGram

MoneyGram offers similar services to Western Union, with a large network of locations and various transfer options.

3.3. Bank Transfers

Sending money directly from one bank account to another is a secure and reliable option, although it may be slower and more expensive than other methods.

3.3.1. Direct Bank Transfers

Most banks offer international wire transfers, allowing you to send money directly to a bank account in Mexico.

3.3.2. Online Banking Platforms

Some banks have online platforms that facilitate international transfers with competitive exchange rates and fees.

3.4. Cryptocurrency Transfers

Cryptocurrency transfers are an emerging option that can offer fast and low-cost transfers, but they also come with certain risks.

3.4.1. Using Bitcoin or Other Cryptocurrencies

You can use cryptocurrencies like Bitcoin to send money to Mexico, but you’ll need to find a reliable exchange to convert the cryptocurrency back into pesos.

3.4.2. Stablecoins

Stablecoins like USDT or USDC offer more stable value than other cryptocurrencies, making them a less risky option for international transfers.

Different methods for sending money to Mexico, highlighting their unique features.

Different methods for sending money to Mexico, highlighting their unique features.

4. Tips for Maximizing Your Money Transfer to Mexico

To get the most out of your money transfer to Mexico, consider these tips:

4.1. Monitor Exchange Rates

Keep a close eye on the exchange rate and try to send money when the dollar is strong against the peso.

4.2. Compare Fees and Commissions

Carefully compare the fees and commissions charged by different services to find the most cost-effective option.

4.3. Consider Transfer Limits

Be aware of any transfer limits imposed by the service or by Mexican regulations.

4.4. Check for Promotions and Discounts

Many money transfer services offer promotions or discounts for new customers or for sending larger amounts.

4.5. Ensure Recipient Information is Accurate

Double-check all recipient information to avoid delays or complications.

4.6. Understand Tax Implications

Be aware of any potential tax implications of sending money to Mexico, both in the US and in Mexico.

4.7. Use Secure Transfer Methods

Only use reputable and secure money transfer services to protect your funds.

4.8. Consider the Recipient’s Needs

Consider how the recipient needs to access the funds (e.g., cash pickup, bank deposit) and choose a service that meets their needs.

5. The LGBTQ+ Community and Financial Practices in Mexico

When sending money to Mexico, it’s essential to be aware of the financial landscape and how it might affect the LGBTQ+ community.

5.1. Financial Inclusion for LGBTQ+ Individuals

Financial inclusion ensures that everyone, regardless of sexual orientation or gender identity, has access to financial services and products.

5.2. LGBTQ+ Friendly Financial Institutions

Some financial institutions are known for their LGBTQ+ friendly policies and practices, ensuring a safe and welcoming environment for all customers.

5.3. Supporting LGBTQ+ Businesses in Mexico

When sending money to Mexico, consider supporting LGBTQ+ owned businesses and organizations, which can help promote economic empowerment and equality.

5.4. Resources for LGBTQ+ Financial Advice

Several organizations offer financial advice and resources tailored to the LGBTQ+ community, helping individuals make informed financial decisions.

6. Legal and Regulatory Considerations for Sending Money to Mexico

Sending money to Mexico is subject to certain legal and regulatory requirements, both in the US and in Mexico.

6.1. US Regulations

US regulations require money transfer services to comply with anti-money laundering (AML) and know your customer (KYC) requirements.

6.2. Mexican Regulations

Mexican regulations impose limits on the amount of money that can be received without reporting requirements.

6.3. Reporting Requirements

Transfers exceeding certain amounts may need to be reported to the relevant authorities.

6.4. Tax Implications

Be aware of any potential tax implications of sending money to Mexico, both in the US and in Mexico.

7. Safety and Security Tips for Money Transfers

Protecting your money and personal information is crucial when sending money to Mexico.

7.1. Use Reputable Services

Only use reputable and secure money transfer services to protect your funds.

7.2. Protect Your Personal Information

Never share your personal or financial information with untrusted sources.

7.3. Be Wary of Scams

Be aware of common money transfer scams and take steps to protect yourself.

7.4. Use Secure Payment Methods

Use secure payment methods like credit cards or bank accounts to pay for your transfer.

7.5. Monitor Your Transactions

Regularly monitor your transactions to detect any unauthorized activity.

8. Exploring LGBTQ+ Tourism in Mexico

Mexico is becoming an increasingly popular destination for LGBTQ+ travelers, offering a welcoming and diverse culture.

8.1. LGBTQ+ Friendly Destinations in Mexico

Some of the most popular LGBTQ+ friendly destinations in Mexico include Puerto Vallarta, Mexico City, and Cancun.

8.2. LGBTQ+ Events and Festivals

Mexico hosts several LGBTQ+ events and festivals throughout the year, attracting visitors from around the world.

8.3. LGBTQ+ Owned Businesses

Supporting LGBTQ+ owned businesses is a great way to contribute to the local community and promote inclusivity.

8.4. Safety Tips for LGBTQ+ Travelers

While Mexico is generally welcoming, it’s essential to be aware of local customs and laws to ensure a safe and enjoyable trip.

Puerto Vallarta, a popular LGBTQ+ destination in Mexico.

Puerto Vallarta, a popular LGBTQ+ destination in Mexico.

9. Resources for LGBTQ+ Travelers in Mexico

Numerous resources are available to help LGBTQ+ travelers plan their trips to Mexico.

9.1. LGBTQ+ Travel Guides

LGBTQ+ travel guides provide valuable information on destinations, accommodations, and activities.

9.2. LGBTQ+ Travel Blogs

LGBTQ+ travel blogs offer personal insights and recommendations from experienced travelers.

9.3. LGBTQ+ Travel Agencies

LGBTQ+ travel agencies specialize in creating customized itineraries for LGBTQ+ travelers.

9.4. LGBTQ+ Community Centers

LGBTQ+ community centers in Mexico can provide valuable resources and support for travelers.

10. Conclusion: Making Informed Financial Decisions

Sending money to Mexico requires careful consideration of various factors, including exchange rates, fees, and safety. By staying informed and using reputable services, you can ensure that your money arrives safely and efficiently. For more information and resources, visit gaymexico.net.

Understanding the current dollar exchange rate in Mexico, particularly at Elektra, is essential for making informed financial decisions. With the right information and tools, you can maximize the value of your money and support the LGBTQ+ community in Mexico. Keep an eye on currency movements, consider all your options, and stay safe when transferring funds.

Ready to explore Mexico? Visit gaymexico.net for travel guides, event listings, and community connections!

Address: 3255 Wilshire Blvd, Los Angeles, CA 90010, United States

Phone: +1 (213) 380-2177

Website: gaymexico.net

Frequently Asked Questions (FAQs)

1. What is the current dollar exchange rate in Mexico at Elektra?

The dollar exchange rate at Elektra fluctuates daily based on market conditions. It’s best to check Elektra’s official website or visit a branch for the most up-to-date rate.

2. Is it better to send money to Mexico through Elektra or another service?

It depends on your priorities. Elektra is convenient due to its widespread locations, but other services like Pangea, Wise, or Remitly may offer better exchange rates and lower fees.

3. What are the fees for sending money to Mexico through Elektra?

Elektra’s fees vary depending on the amount you’re sending and the service you’re using to transfer the money. Check with the money transfer service for specific fee information.

4. How can I find the best exchange rate for sending money to Mexico?

Monitor exchange rates on financial websites, compare rates from different money transfer services, and consider sending money when the dollar is strong against the peso.

5. Are there any limits on how much money I can send to Mexico?

Yes, both US and Mexican regulations impose limits on the amount of money that can be sent without reporting requirements. Check with the money transfer service for specific limits.

6. What documents do I need to send money to Mexico?

You’ll typically need a valid government-issued ID and the recipient’s full name and address. Some services may require additional information.

7. How long does it take for money to arrive in Mexico when sent through Elektra?

The time it takes for money to arrive in Mexico varies depending on the service you’re using. Some services offer instant transfers, while others may take a few days.

8. Is it safe to send money to Mexico through Elektra?

Yes, Elektra is a reputable company, but it’s essential to use secure money transfer services and protect your personal information to avoid scams.

9. What happens if the recipient has a debt with Elektra?

Elektra may use incoming funds to offset any existing debts the recipient has with the company, as stipulated in their contract.

10. Can I send money to myself in Mexico through Elektra?

Yes, you can send money to yourself in Mexico through Elektra using a money transfer service that partners with Elektra.